When you load an uncosted imports batch, Micronet loads all the items received in the shipment and displays them on the Reconcile Imports screen. If there is only one invoice for a shipment, you simply enter the invoice details on the default Reconcile Imports Header screen.

However, there may be more than one supplier invoice associated with a shipment, e.g. separate invoices from different suppliers or for different goods received in the shipment. In this case, you need to enter the details of each invoice on a new Reconcile Imports Header screen.

To enter the details of a shipment's first and subsequent supplier invoices:

Refer to "Recalling an Uncosted Imports Batch".

Micronet displays the Reconcile Imports screen.

Refer to "Reconcile Imports - Change Invoice".

Micronet displays the item lines associated with the selected invoice.

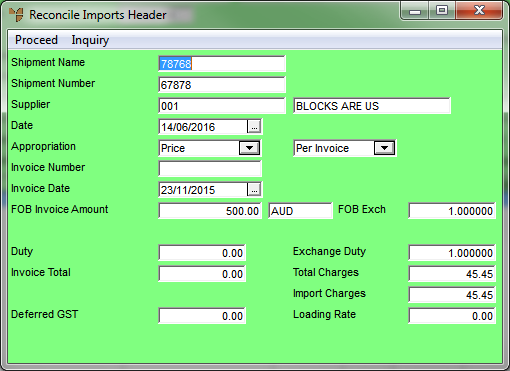

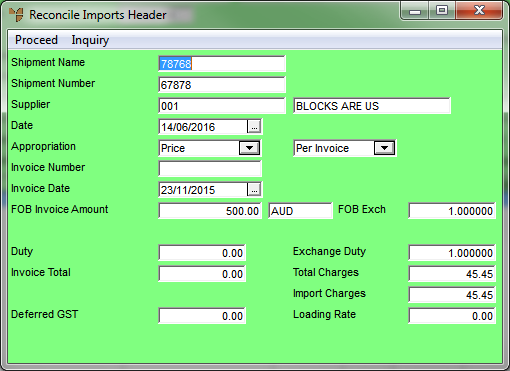

Micronet displays the Reconcile Imports Header screen.

|

|

Field |

Value |

|

|

Shipment Name |

Micronet displays the shipment name entered when the import costing batch was created. You can change this if required. |

|

|

Shipment Number |

Micronet displays the shipment number entered when the import costing batch was created. You can change this if required. |

|

|

Supplier |

Micronet displays the ID and description of the supplier of the imported goods. You can change this if required. |

|

|

Date |

Micronet displays today's date. Enter or select a different date for this reconciliation if required. |

|

|

Appropriation |

Select the appropriation method you want to distribute your costs by. Options are:

Use the second drop down list to select whether you want the costs averaged:

|

|

|

|

Technical Tip Weights and volumes can be directly updated to the Inventory master file from the import costing transaction screens. |

|

|

Invoice Number |

Enter the supplier's invoice number. When you enter an invoice number, the information you enter in the Reconcile Imports Header screen updates the Creditors Ledger transaction files. |

|

|

Invoice Date |

Enter the date on the supplier's invoice. This date will be posted to the Micronet Creditors Ledger (MCL). |

|

|

FOB Invoice Amount |

Enter the total invoice amount from the supplier's invoice in your supplier's base currency. The supplier's exchange rate ID appears next to the Invoice Amount. |

|

|

|

Technical Tip Only enter the value of the goods or inventory appearing on the supplier's invoice. Do not include any freight or other chargeable component, as these items are considered landed charges and should be appropriated over the value of the products in the shipment or on that invoice. They are entered elsewhere in the import costing transaction. |

|

FOB Exch |

Enter the exchange rate for the Free on Board (FOB) amount. Micronet defaults to the current exchange rate applicable to your supplier from the Exchange Rates master file. You may accept the default or override/enter the exchange rate as applicable. |

|

Duty |

There are two ways to appropriate duty on goods. These are:

When you move to this field, Micronet displays the Enter Duty Charge screen. Only use this screen if duty tables have been setup. Leave all the fields blank if there is one duty rate applicable to all imported items (see the note below).

Complete the following fields:

Select the OK button to return to the Reconcile Imports Header screen. |

|

|

|

Technical Tip Where the duty rate on all imported goods is the same, duty charges can be appropriated by the same method as other import charges - that is, using the Total Charges field below. |

|

|

Exchange Duty |

Enter the exchange rate to calculate the duty amount. Micronet defaults to the current exchange rate applicable to your supplier. You may accept the default or override/enter the exchange rate as applicable, i.e.: Duty = ItemFOB/ExchangeDuty * Duty%/100 |

|

|

Invoice Total |

|

|

|

Total Charges |

When you move to this field, Micronet displays the Import Costing Charges screen. Refer to "Reconcile Imports Header - Import Costing Charges" for more information. |

|

|

Import Charges |

|

|

|

Deferred GST |

If you are registered in the “Deferred GST Scheme” with the ATO, enter the GST amount here. Micronet will post the relevant figures to the General Ledger. |

|

|

Loading Rate |

As items are received, the calculated item landed cost price can be loaded by a percentage increase. The increased cost price is posted to Stock On Hand and Goods Received in your GL. The Loading Rate is a percentage rate that can be applied to the calculated item landed cost price. For example, if the new landed cost was $12.00 and you had a loading of 10%, then Micronet would receipt the item at a total cost price of $12.00 + 10% = $13.20. |

Refer to "Reconcile Imports Header - Inquiry".

Micronet displays the Dissect Import Cost screen. Refer to "Dissecting an Uncosted Import" for information on using that screen.